Waya: A Bank Helping Immigrants Thrive

The past two years have been characterized by an ardent change in people’s attitudes towards money and financial security. The COVID-19 pandemic was a wake-up call for many people to get their financial lives in order and to stay prepared for similar rainy days by safeguarding their financial future.

Whether it is by building credit, budgeting, buying a house, or paying off debt, building one’s financial life from scratch is no easy feat. It’s often a daunting task that many people are unable to hack– not by lack of ability but by lack of the proper tools. Waya is working to build these tools, organizing them in a manner that makes banking easy, trustworthy, accessible, and tailored toward the specific needs of our customers.

Where it all began?

Founded in 2019, Waya was started as a Fintech company managing cross-border money transfers for the immigrant population in the United States. Our mission was to enable people to send and receive money across the United States and in different places in Sub-Saharan Africa efficiently, transparently, and affordably through the platform.

Three years later, Waya has evolved into a centralized Neo banking platform that will not only offer remittance services but serve all other banking needs with the aim of helping the immigrant community gain financial stability and build personal and family financial freedom.

Why Immigrants?

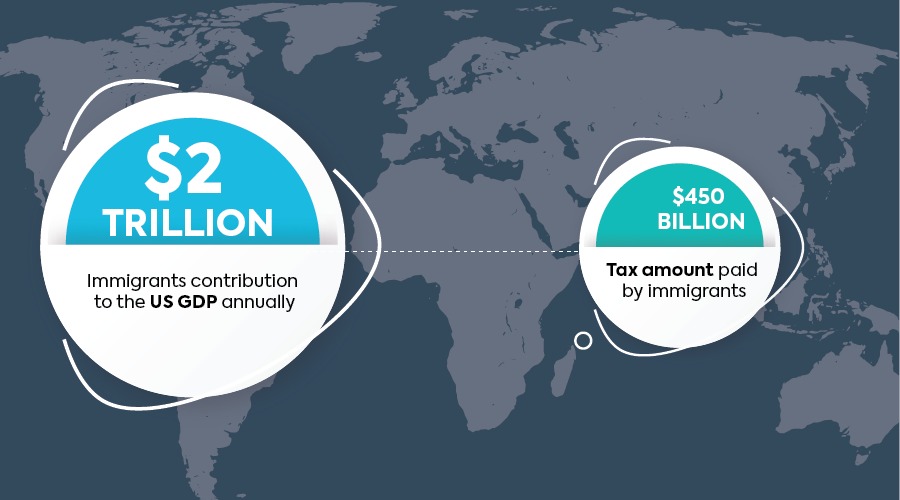

With the vast and growing population of immigrants in the United States, it goes without saying that immigrants are significant contributors to the US economy. They contribute over $2 trillion to the U.S. GDP annually and pay over $450 billion in tax. Still, this critical population remains underserved since most financial institutions do not have products that are tailored towards the specific needs of immigrants, such as building credit safely and getting quick access to cash.

Here’s how Waya is working to solve these pain points:

What do we offer?

Our platform offers core products like checking and savings accounts tailored to help you spend smartly and save for the days ahead – rainy or sunny.

Beyond these core features, we offer remittance services between the United States and sub-Saharan Africa. You can also transfer money to mobile money wallets like M-Pesa, Airtel Money, and MTN, which are ubiquitous in Africa and whose use is transforming how transactions are conducted in most parts of the continent.

Furthermore, through Waya, you can conduct person-to-person transactions to another Waya account.

These products are built to help you save and manage your finances to secure your future and support your loved ones back home.

Waya’s unique touch

We use innovative banking technology to ensure that we correctly match our customers with their respective needs. For instance, we curate personal offerings that can guide people on how to embrace financial security as per their needs.

Besides, our team, which has experienced firsthand the hassle of being in an underserved and underbanked market, gives the human touch to our products, ensuring that we have human-centric products that offer an A-class user experience.

Waya is here to help!

Unlike many banks that benefit from the customer’s financial illiteracy and the consequent outcomes like overdrafts, bad credit, and subprime mortgages, our main aim is financial inclusion. As such, we offer you a one-stop platform where you can get all previously dispersed products and a guide on achieving financial wellness and realising your financial goals.

At Waya, we are a partner that understands you and knows how to cater to your exact needs. We are willing to pave the way for you as you work towards getting a hold of your financial life. Most importantly, we are focused on the financial wellness of immigrants. As such, we work towards ensuring that they are financially literate and that their financial future is secure through our products that are particularly tailored for them.